Croatia, Dalmatia coast, Rogoznica - Very attractive, modern villa with swimming pool

ID: 2022/178Basic information

Living space:268 m2

Land space:500 m2

Bedrooms:4

Bathrooms:4

Floors:3

Sea distance:30 m

Property advantages

- Sea view

- Swimming pool

- Newly built

- Luxury

Amenities

- Energy Certificate

- Garage

- Modern

- Parking

About the property

Very modern and attractive villa for sale, positioned at the 2nd row from the sea.

Micro location is perfect, at the end of dead-end street, with easy access by car, paved road, and also easy access from the villa to the beach.

Villa will be finished and ready to move in at the Summer 2020, and it will be sold by the system: turnkey.

So, villa is placed on a plot of 500m2, with a total living area 268m2.

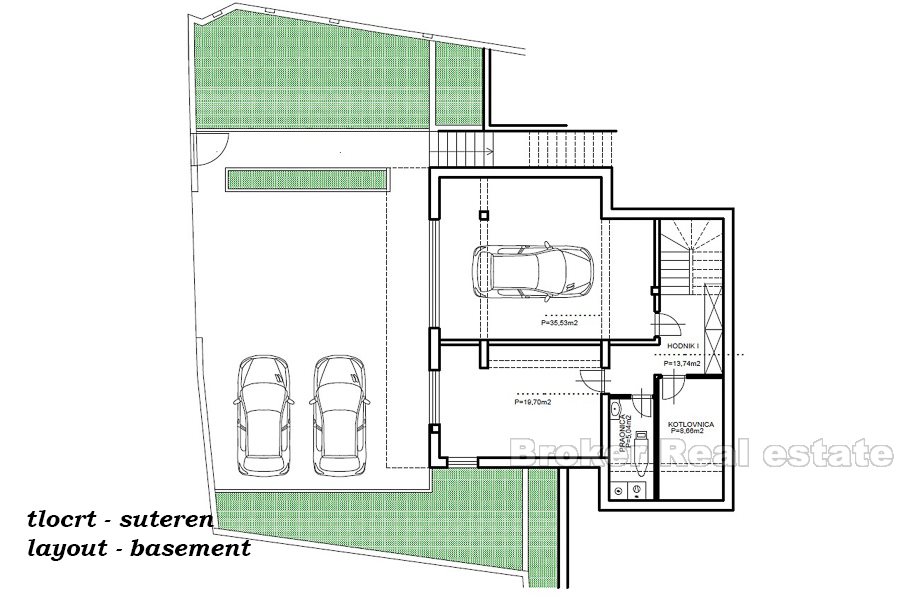

It consist of basement floor where is spacious garage of 35m2, pantry, boiler room, laundry room, all together total of 82m2.

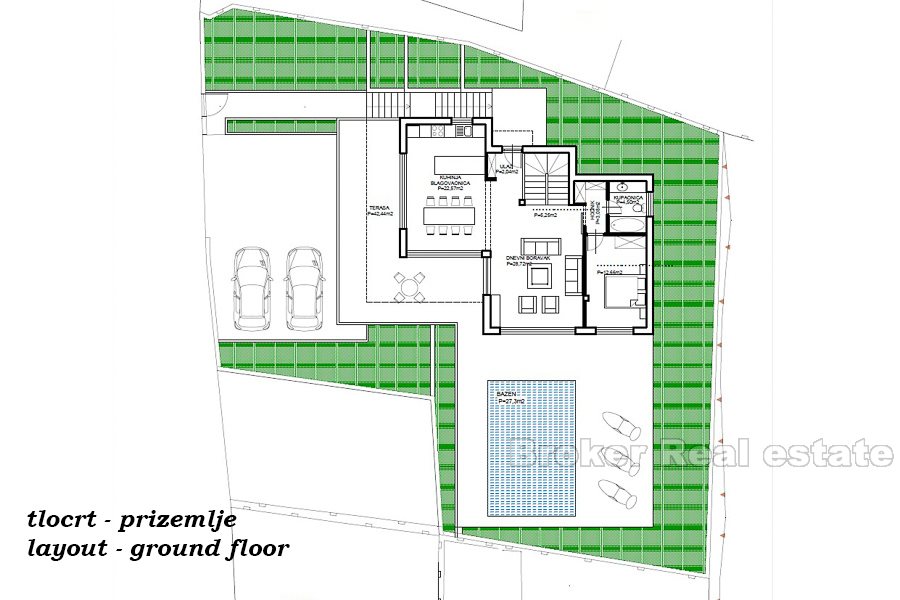

On the ground floor of 100m2, there is spacious living area with kitchen, dining area, an bedroom, bathroom, spacious terrace and beautiful sunbath area with a swimming pool of 27m2.

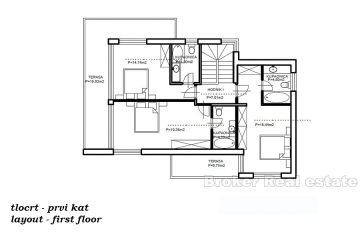

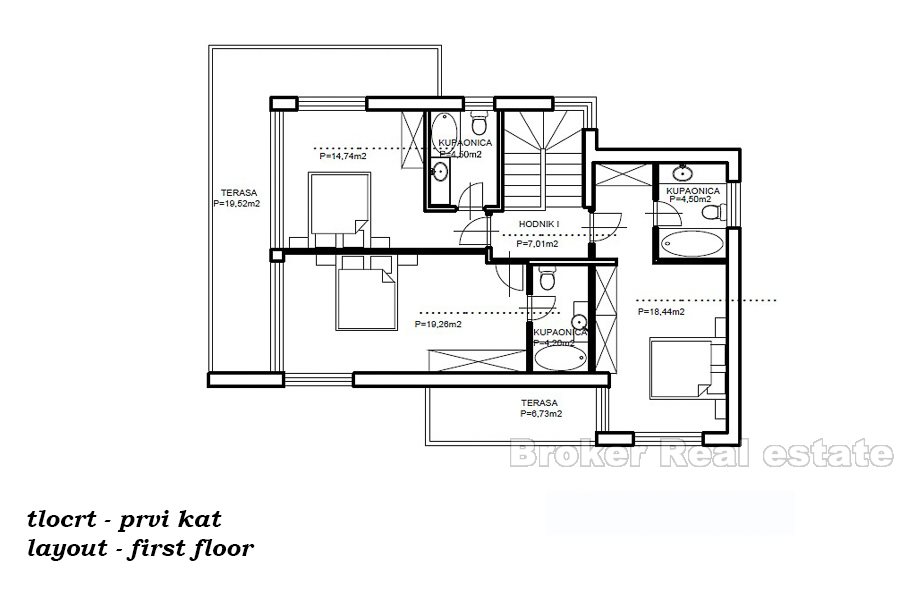

At the first floor, total size of 85.78m2, there is 3 bedrooms with 3 bathrooms, balcony, terrace.

The villa has 4 additional open parking places.

Property offers all necessary infrastructure.

Distance to the city of Rogoznica is 4 kilometers, while airport of Split is 30 kilometers away.

Location

Are you looking for something else?