Croatia, Istria and Kvarner, Labin - Beautiful villa, built in the Roman style

ID: 4001/30Basic information

Living space:240 m2

Land space:780 m2

Bedrooms:3

Bathrooms:3

Floors:1

Sea distance:3000 m

Property advantages

- Swimming pool

Amenities

- Energy Certificate

- Garage

About the property

Beautiful villa, built in the Roman style, living space of 240 m2 and 780 m2. The villa consists of apartments of 100 m2 with a terrace of 30 m2, 2 bedrooms, bathroom with sauna, bathroom, living room with fireplace, kitchen, terrace. The apartment is air conditioned.

2 car garage, 40 m2, the door opens to the remote control.

Apartment for guests or servants, of 39 m2, with SOOBO bedroom, kitchen, living room, bathroom, and he also air-conditioned.

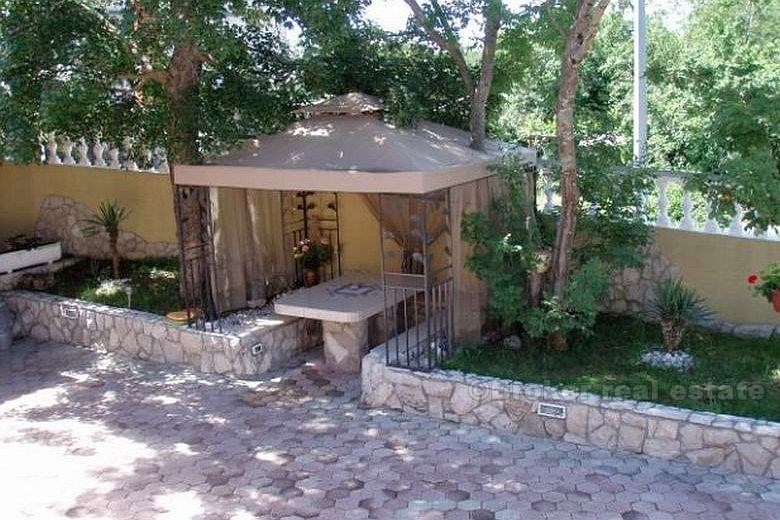

Pool of 8×4 meters. Pavilion, terrace area of approximately 150 m2.

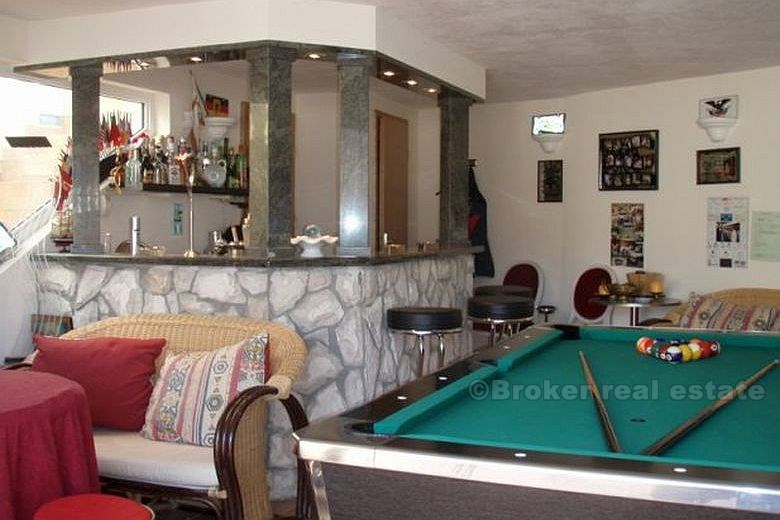

Cellar of 40 m2, risks being unprepared billiard table, summer kitchen, bathroom, fireplace, storage space and air conditioning.

The villa has a beautiful view of the old town of Labin, located near the town, approximately 2 km and 3 km from the sea.

Location

Are you looking for something else?