Croatia, Dalmatia coast, Opuzen - House in the Neretva valley, for sale

ID: 4782/30Basic information

Living space:280 m2

Land space:2800 m2

Bedrooms:4

Bathrooms:4

Floors:3

Amenities

- Energy Certificate

- Parking

About the property

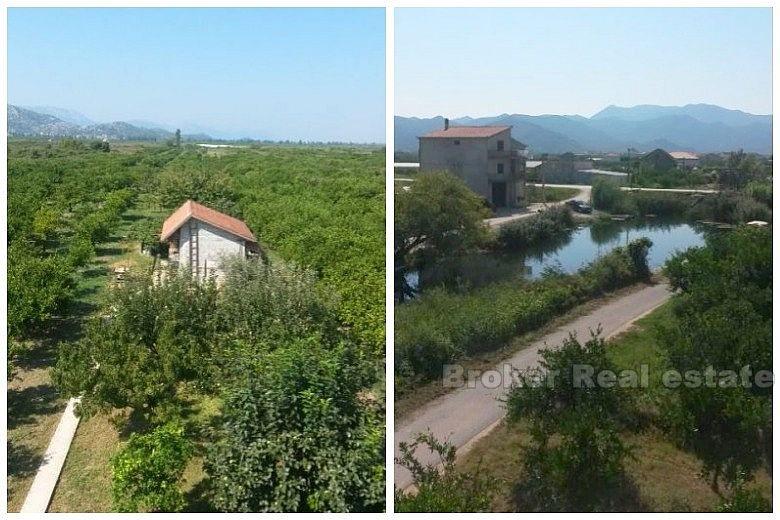

The house is situated in a quiet location, in the valley of the Neretva river, 4 min from the sea. The property price includes 2800 sqm of

land with a small detached property that serves as a storage room for tools, with 250 of tangerine trees that are ready to pick in the month of October

and a significant number of seasonal fruit trees such as cherry, figs, kiwi, apples, pears …

The house itself has a living space of 280 m2 and consists of:

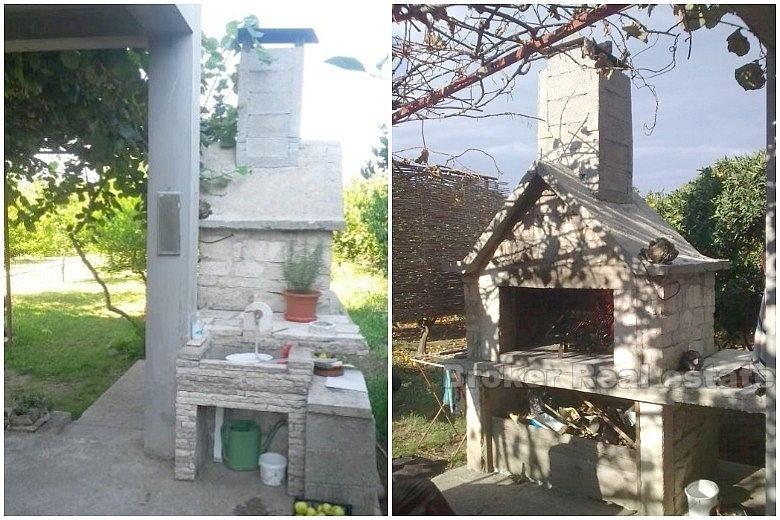

– Large ground floor with living room and kitchen, hallway and wc and exit to the yard

– First floor with 3 bedrooms, two of which have large balconies and bathrooms

– Large attic with separate entrance, with 2 double balconies offering a beautiful view of the Neretva Valley. It consists of a large living room, a bathroom, a bedroom with a large double bed made of wrought iron, a hand-made kitchen and a large enclosed fireplace.

In front of the house is a small river called Crepina, which gives a certain charm to the real estate. The area where the property is located is only 80 km

away from beautiful Dubrovnik, 70 km from the historic city of Mostar and only a couple of minutes drive from the Neretva river, which offers a wealth

of opportunities for sports and entertainment (kitesurfing), as well as a peaceful and relaxing family holiday.

Location

Opuzen, Dalmatia coast

Opuzen is a small town in Dubrovnik-Neretva County in Croatia. The town is located 12 kilometers upstream from the mouth of the river Neretva, in southern Dalmatia. Starting from Opuzen, the Neretva river splits into twelve backwaters, which are a paradise for sport fishermen. Opuzen is known for growing quality vegetables and fruits, primarily tangerines and kiwis.

Are you looking for something else?