Croatia, Dalmatia islands, Brac - Dalmatian stone house, for sale

ID: 2013/24Basic information

Living space:120 m2

Land space:1000 m2

Bedrooms:3

Bathrooms:4

Floors:2

Sea distance:300 m

Property advantages

- Newly built

- Sea view

- Stone house

- Swimming pool

Amenities

- Best offer

- Parking

About the property

In the small picturesque village, on the north side of the island of Brac, it is sold Dalmatian stone houses, with swimming pool and sea view.

The planned start of construction is after the summer of 2017, and the end of 2018.

The house is located 300 meters from the sea, on a land of about 1000 m2.

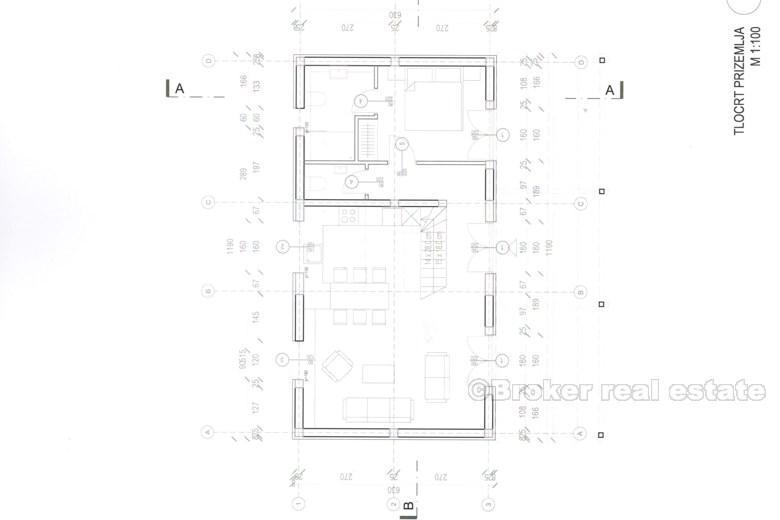

The surface of the house is about 60 m2 and consists of ground floor and gallery that stretches through the entire house.

On the ground floor there is a kitchen with living room and dining room, bedroom, bathroom and toilet.

The gallery consists of 2 bedrooms, 2 bathrooms and 2 smaller rooms that serve as wardrobes.

In front of the house there is a swimming pool of 28 m2, with a beautiful, unobstructed panoramic view of the village, the sea and the coast.

Location

Brac, Dalmatia islands

Brač is with an area of 396 square kilometers the largest island in Dalmatia, and the third-largest island in the Adriatic Sea overall. Brač has a long and folded coastline with numerous smaller and larges bays. Particularly noticeable are the natural harbours of Supetar, Splitska, Pučišća, and Povlja, Sumartin, Milna and Bobovišća.

Are you looking for something else?