Croatia, Dalmatia coast, Dubrovnik - Apartment with the sea view, for renovation

ID: 4887/30Basic information

Living space:97 m2

Bedrooms:3

Bathrooms:1

Floors:2

Sea distance:100 m

Property advantages

- Sea view

Amenities

- Energy Certificate

About the property

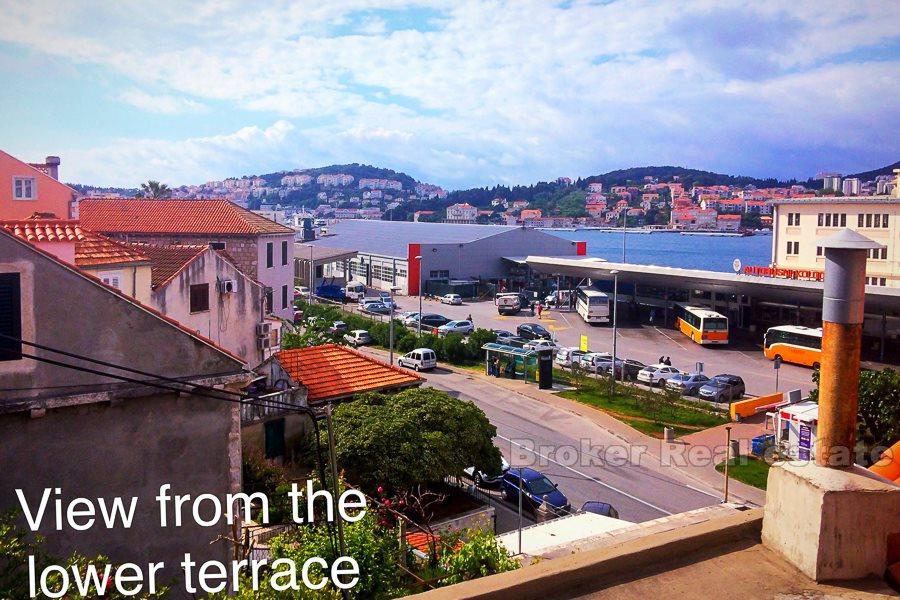

For sale is a comfortable apartment for renovation, located in the city of Dubrovnik. It is a duplex apartment (situated on the 2nd floor and the attic) with excellent sea and harbor views.

Although the apartment does not have its own parking space, nearby there is a public, secured parking place where it is possible to rent a parking space. The property itself is perfectly connected with the rest of the city, as the city bus station is located near the property.

Since the roof of the property is brand new, and the apartment has high ceilings (3m), by lowering the ceiling it is possible to easily get another comfortable attic apartment with a separate entrance from the street. Each floor has its own terrace with a beautiful view of the sea. One of them is raised above the roof level and offers a panoramic view of Mount Srd over the bay Gruz, while the other, larger in size, offers an excellent view of Gruz bay.

Although requiring complete renovation, real estate is an excellent opportunity for a comfortable family home, also offering an option to redefine space into luxury rooms or apartments with a terrace.

Location

Dubrovnik, Dalmatia coast

Dubrovnik is a city in southern Dalmatia, Croatia, by the Adriatic Sea. It is one of the most prominent tourist destinations in the Mediterranean, a seaport and the center of the Dubrovnik-Neretva County. In 1979, the city of Dubrovnik was added to the UNESCO list of World Heritage Sites in recognition of its outstanding medieval architecture and fortified old town.

Are you looking for something else?