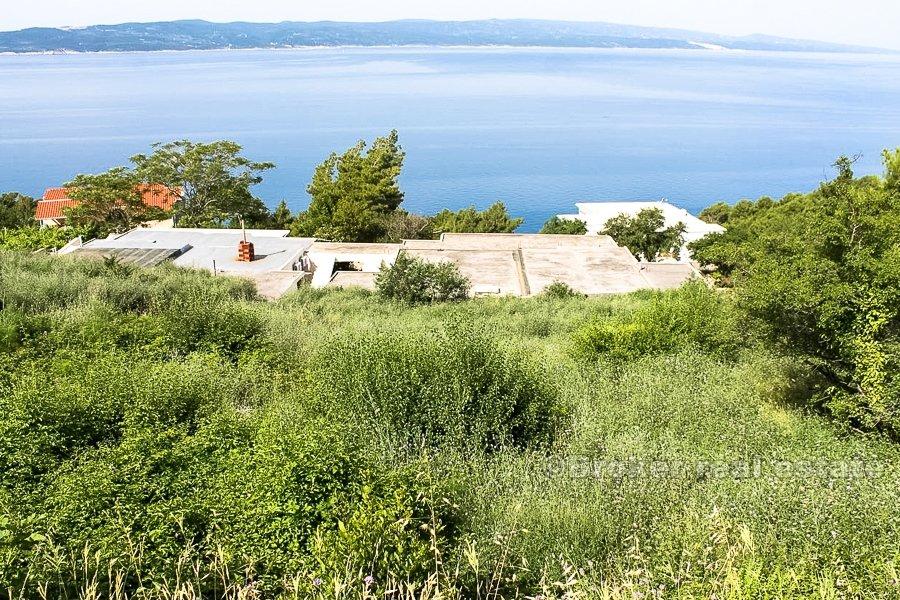

Croatia, Dalmatia coast, Makarska - Building land close to Makarska, on sale

ID: 2016/343Basic information

Land space:1036 m2

Sea distance:200 m

Property advantages

- Sea view

About the property

Building plot for sale, located on the very attractive part of the coast – on Makarska riviera, in a beautiful position with a beautiful panoramic view, 200 meters away from the sea.

The land is rectangular, the road passes directly to the eastern side of the plot, and all the necessary infrastructure is directly on the land plot.

It is very interesting for the land, given the spatial plan of the municipality of Brela, which allows construction of 3 floors, with a floor plan up to 200 m2.

The plot looks very good choice for building a holiday villa, the sea view is fantastic, the center of town is within walking distance, as well as the beautiful pebble beaches that are located 5-6 minutes walk below the plot.

Location

Makarska, Dalmatia coast

Makarska is a prominent regional tourist center, located on a horseshoe-shaped bay between the Biokovo mountains and the Adriatic Sea. The city is noted for its palm-fringed promenade, where cafes, bars and boutiques overlook the harbor. Makarska is the center of the Makarska Riviera, a popular tourist destination under the Biokovo mountain.

Are you looking for something else?