Croatia, Dalmatia coast, Omis - Semi-detached villa with pool, under construction

ID: 2022/300Basic information

Living space:206 m2

Land space:344 m2

Bedrooms:3

Bathrooms:3

Floors:3

Sea distance:300 m

Property advantages

- Sea view

- Swimming pool

- Newly built

Amenities

- Energy Certificate

- Garage

- Modern

- Parking

About the property

Semi-detached villa with a total living area of 206 m2, located in a small village near the town of Omis, 300 meters from the sea.

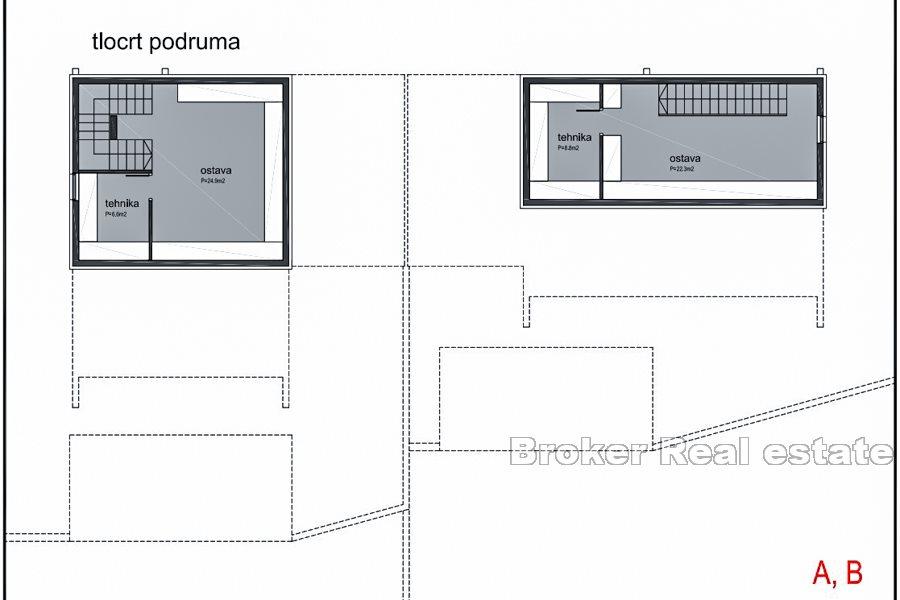

The villa consists of three floors – basement, ground floor and first floor.

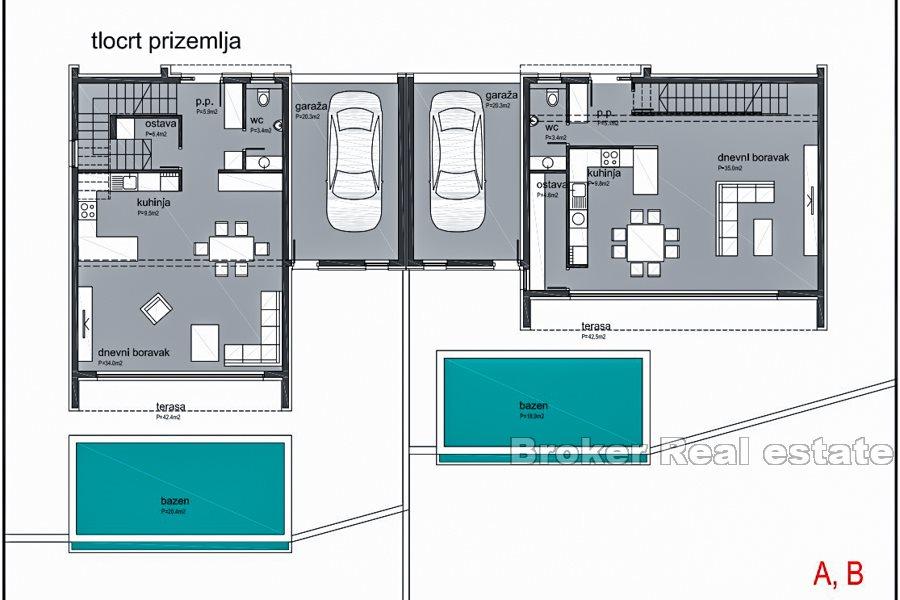

On the ground floor there is a spacious living room, kitchen with dining area, guest toilet and a small storage room. An internal staircase leads to the basement, which serves as a storage room and space for equipment and maintenance of the villa.

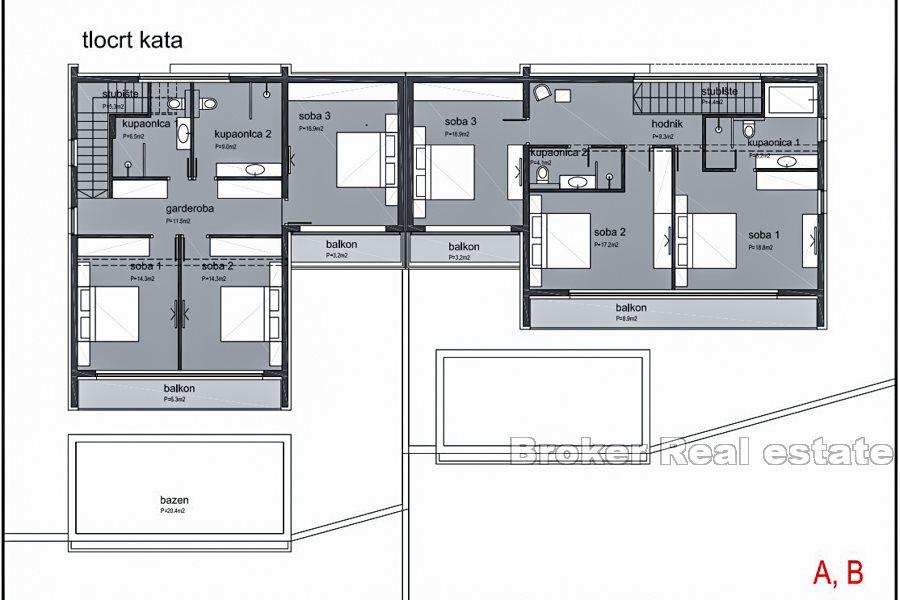

On the first floor there are two bathrooms and three bedrooms, two of which have additional space for a wardrobe. Each room has a balcony overlooking the sea.

There is air conditioning and heating in all rooms, underfloor heating and solar equipment. The large glass walls used in the decoration illuminate the space with natural light.

From the ground floor there is an exit to the landscaped garden with a total area of 344 m2. The garden contains a terrace with an infinity pool.

The villa has one garage space and outdoor parking for two cars.

Nearby there are numerous bays with beaches, restaurants with a rich traditional gastronomic offer and sports and recreational facilities. All of the above as well as good transport with major tourist towns make the property ideal for a holiday.

Location

Omis, Dalmatia coast

Omiš is a town and port in the Dalmatia region of Croatia, and a municipality in the Split-Dalmatia County. The town is approximately 25 kilometers southeast of Croatia's second-largest city, Split, where the Cetina River meets the Adriatic Sea. Omiš was well known in the past as a pirate city whose ships were built for attack and fast retrieval into the mouth of the Cetina River.

Are you looking for something else?