Croatia, Istria and Kvarner, Porec - House with pool

ID: 1014/21Basic information

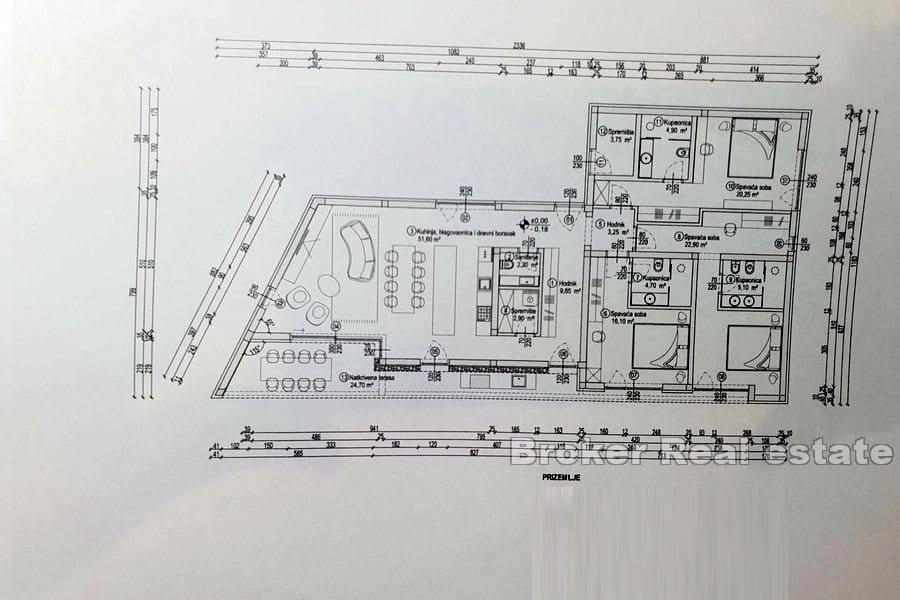

Living space:159 m2

Land space:775 m2

Bedrooms:3

Bathrooms:4

Sea distance:5000 m

Property advantages

- Newly built

- Sea view

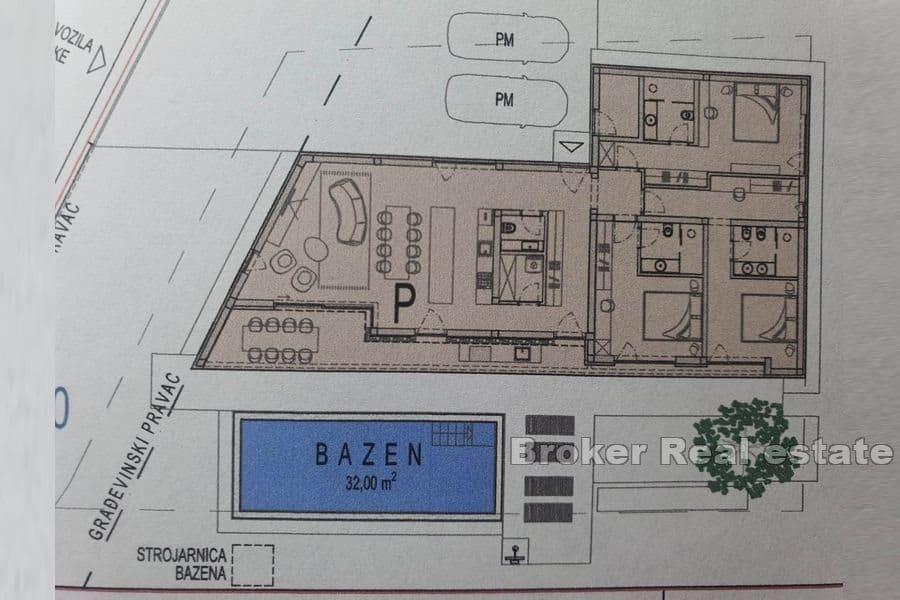

- Swimming pool

Amenities

- Energy Certificate

- Modern

- Parking

About the property

Newly built house with a pool in the nature of a single-storey house located 5 km from the sea and 9 km from Poreč.

The house with a total living area of 159 m2 is located on a plot of land of 775 m2 and is part of a newly built luxury real estate complex.

It consists of a hallway, a spacious living room with kitchen and dining room, 2 storage rooms, three bedrooms, three bathrooms and a toilet.

From the living room there is access to the covered terrace that leads to the 32 m2 swimming pool. Underfloor heating is installed and it is air-conditioned.

The yard is decorated with Mediterranean plants and has two parking spaces.

Poreč is a city located right on the sea, on the western part of the Istrian peninsula. The city has an indented sea coast 37 km long, which stretches from the mouth of the Mirna River to the small town of Funtan, and is one of the main tourist centers in Croatia.

Location

Porec, Istria and Kvarner

Poreč is a town on the western coast of the Istrian peninsula, in Istria County, west Croatia. Its major landmark is the 6th-century Euphrasian Basilica, which was designated a UNESCO World Heritage Site in 1997. The town is almost 2,000 years old and is set around a harbor protected from the sea by the small island of Saint Nicholas.

Are you looking for something else?