Croatia, Dalmatia coast, Primosten - Detached stone house on the outskirts, for sale

ID: 4805/30Basic information

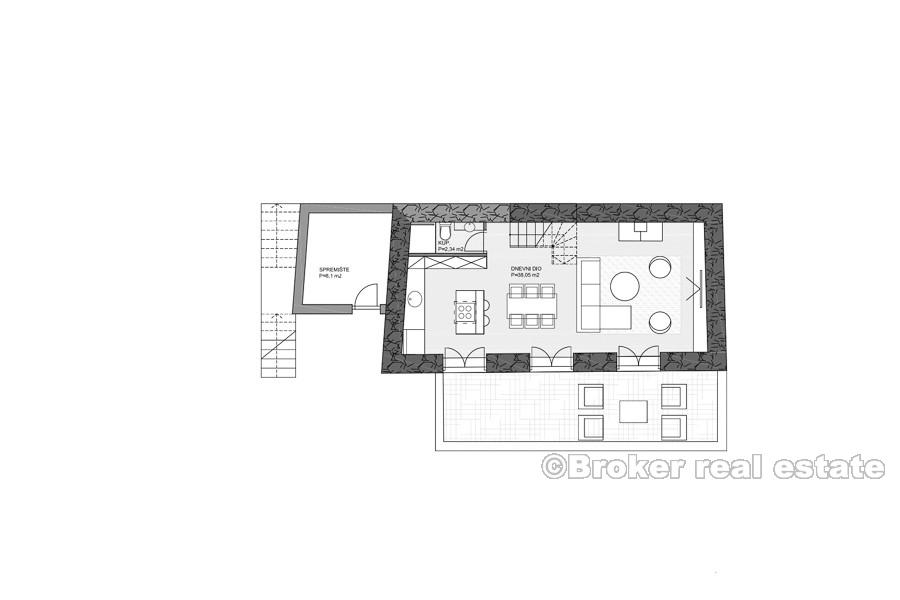

Living space:66 m2

Land space:628 m2

Property advantages

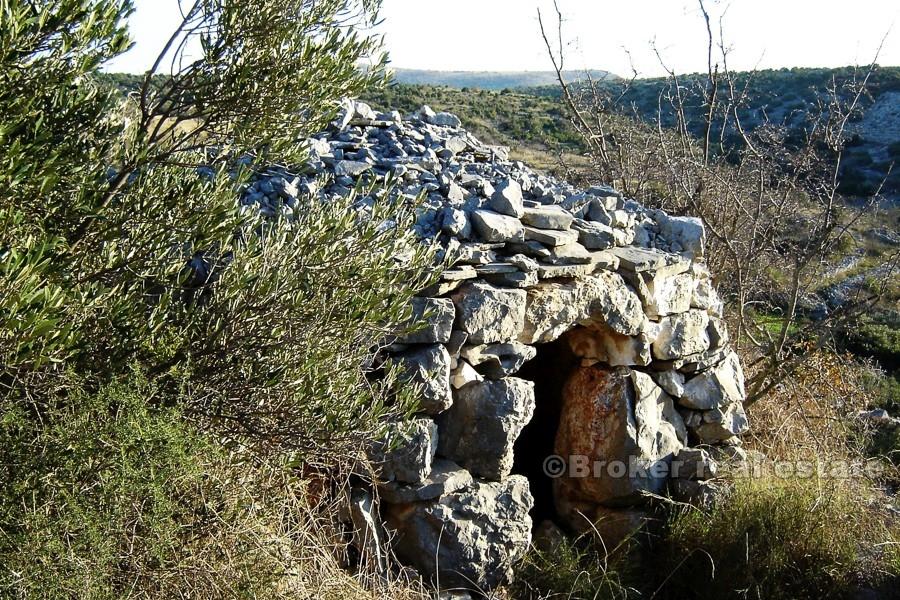

- Stone house

About the property

Ruined stone house in a secluded area of approximately 66m2, situated on a plot of 628m2, situated 2km from Primosten, sea and beach, in the uninhabited hamlet surrounded by vineyards protected.

The existing house has stone walls of 60 cm wide, and one wall of the house is on the rock.

Because of the residential area and barn that is depicted, the object can be arranged about 90m2 ground floor + attic.

The path to the parcel exists on both sides.

On the upper side there is a rightful way that could be arranged in agreement with other users.

The lower path is official, drawn, the width of a car. Electricity and water are nearby.

The property is ideal for nature lovers, and with the necessary reconstruction you can get a charming oasis of peace.

The city is close to Primosten, which is a popular tourist destination, a blend of modern and traditional way of life, this property offers great tourism potential (villa with pool) as well as escape from the noise and hectic lifestyle.

Location

Primosten, Dalmatia coast

Primošten is a village and municipality in Šibenik-Knin County, Croatia. It is situated in the south, between the cities of Šibenik and Trogir, on the Adriatic coast. Primošten is famous for its huge and beautiful vineyards. The largest beach in Primošten is called Raduča, and its smaller part, Mala Raduča, is voted one of the 10 most beautiful beaches in Croatia.

Are you looking for something else?