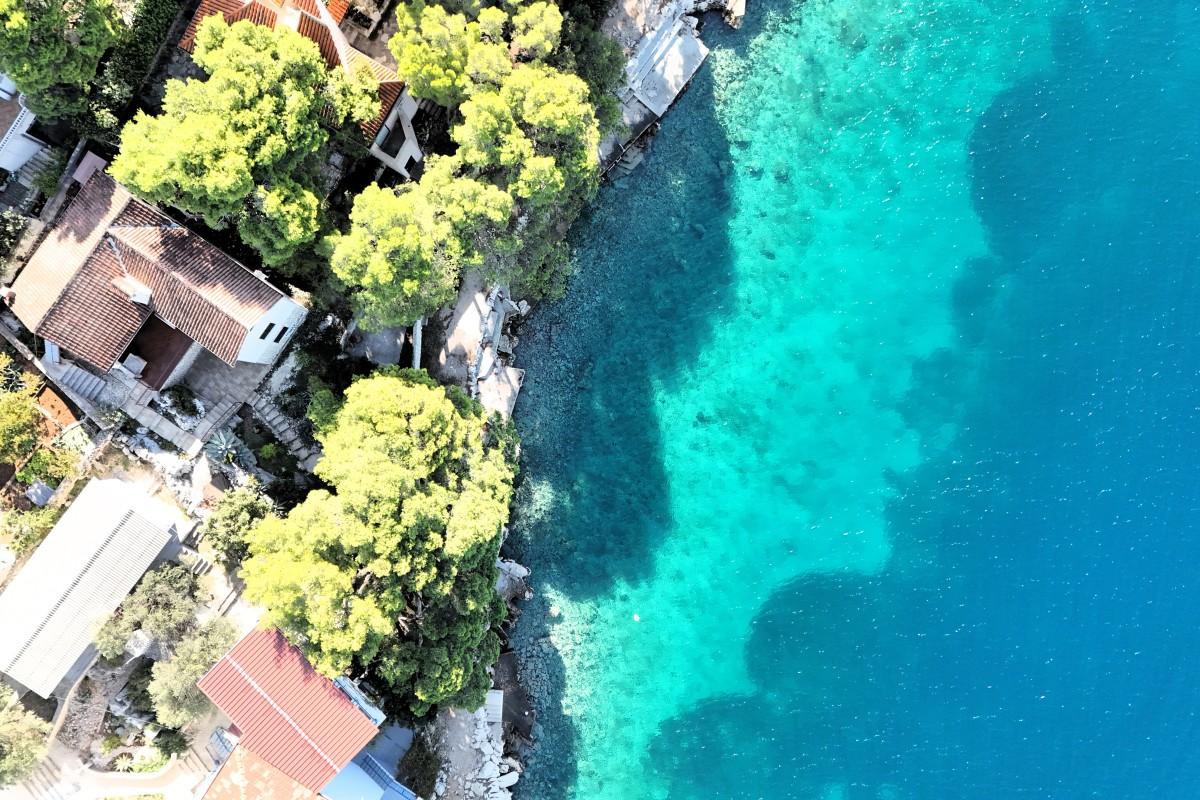

Croatia, Dalmatia coast, Rogoznica - Beautiful house with pool and sea view

ID: 2043/36Basic information

Living space:65 m2

Land space:776 m2

Bedrooms:2

Bathrooms:1

Floors:1

Sea distance:400 m

Property advantages

- Sea view

- Swimming pool

Amenities

- Energy Certificate

- Modern

- Parking

About the property

The house with a smaller living area of 65 m2 is located on a plot of 776 m2 with an exceptional view of the sea. A lot of effort was put into the house and garden, which can be seen in the contents and decoration. The yard includes a parking lot with at least 4 parking spaces, a swimming pool, a barbecue, and rich horticulture that significantly affects the landscaping.

The house consists of a kitchen, a dining room and a small living room with access to a covered terrace, two bedrooms and one bathroom. On the north side of the house there is a storage room of 6m2 for which there is a possibility of arranging another bathroom because all the installations and openings have been carried out. The modern style of decoration fits in with the area where the house is located. The exceptional view from the spacious terrace will not leave anyone indifferent.

The house is ideal as a family holiday home or as an investment due to the already well-established tourist business, which has proven to be extremely successful in recent years.

Location

Rogoznica, Dalmatia coast

Rogoznica is a municipality and a popular tourist village on the Dalmatian coast in Croatia that lies in the southernmost part of the Šibenik-Knin County, in a deep bay sheltered from the wind, about 30 km from Šibenik. It is occasionally called Šibenska Rogoznica to distinguish it from Lokva Rogoznica, another tourist resort in Dalmatia.

Are you looking for something else?