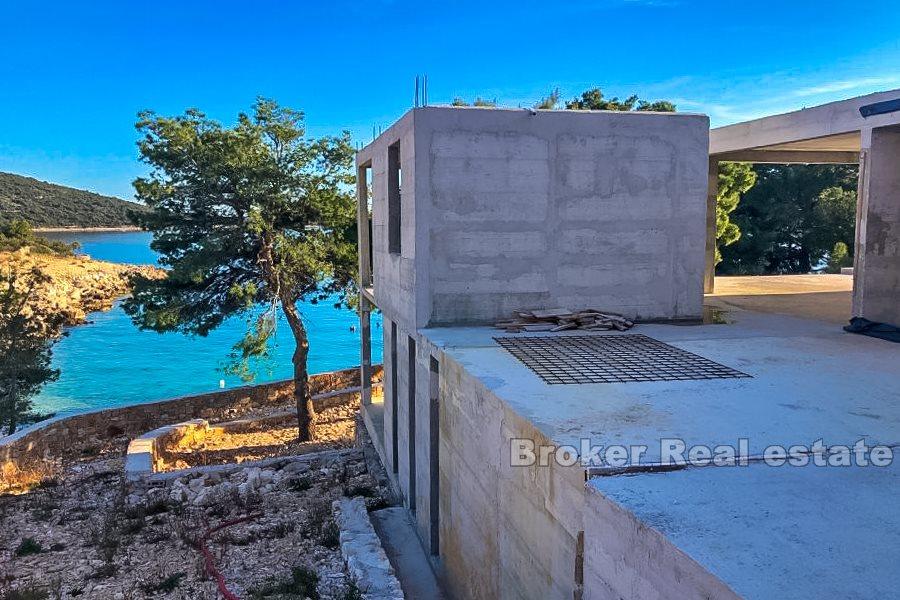

Croatia, Dalmatia coast, Rogoznica - Unfinished villa on exceptional location

ID: 2022/04Basic information

Living space:380 m2

Land space:1115 m2

Bedrooms:4

Bathrooms:4

Floors:2

Sea distance:5 m

Seafront

Property advantages

- Sea view

- Newly built

Amenities

- Energy Certificate

- Garage

- Parking

About the property

This property is located in the first row to the sea, in a prestigious location, away from city noise, traffic and tourists, with south orientation.

A road leads to the building, and it is located in a green zone, without the possibility of building new surrounding buildings.

On a plot of 1115 m2 there is an unfinished villa of huge potential, with a total gross area of 380 m2, on 2 floors.

The conceptual design is so that the ground floor will have a recreation room, pantry, toilet, and two bedrooms, each with its own bathroom, with the possibility of an indoor pool.

Upstairs are a kitchen with living room and dining room, pantry, hallway, and two bedrooms with bathrooms and two large and spacious terraces.

Border of the land is surrounded by a quality dry stone wall, has direct access to the sea, and right next to the property there is a small and beautiful pebble beach. The bay is protected from all winds, and provides peace, solitude and a very pleasant vacation from everyday noise.

Given that the property is newly built, unfinished, the property has great potential for completion.

Split Airport is 30 km away.

Location

Rogoznica, Dalmatia coast

Rogoznica is a municipality and a popular tourist village on the Dalmatian coast in Croatia that lies in the southernmost part of the Šibenik-Knin County, in a deep bay sheltered from the wind, about 30 km from Šibenik. It is occasionally called Šibenska Rogoznica to distinguish it from Lokva Rogoznica, another tourist resort in Dalmatia.

Are you looking for something else?