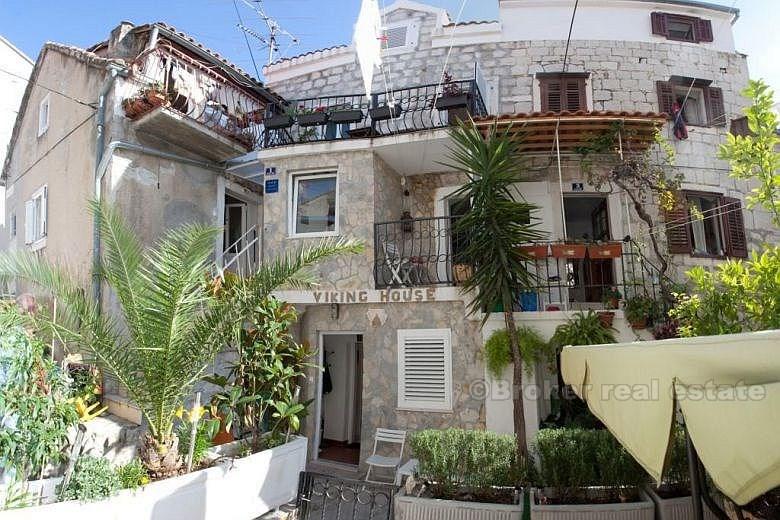

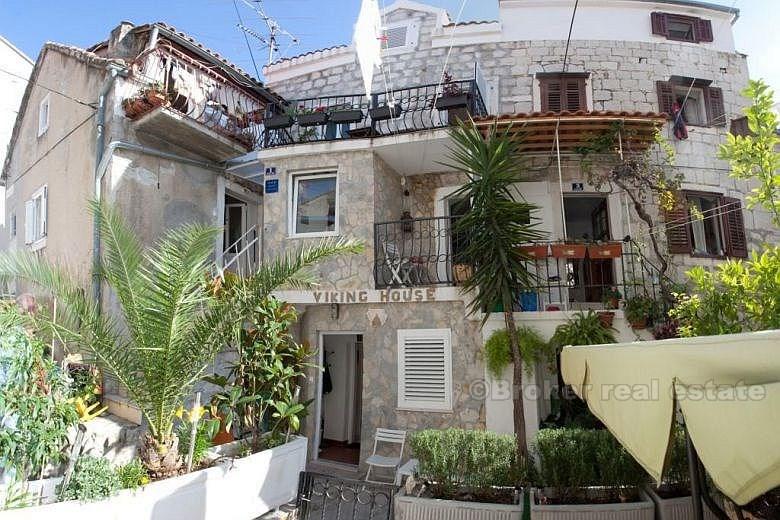

Croatia, Dalmatia coast, Split city - Luxury renovated stone house, for sale

ID: 3795/30Basic information

Living space:132 m2

Land space:10 m2

Bedrooms:5

Bathrooms:3

Floors:4

About the property

Luxury renovated stone house in the oldest district in Split, with 4 floors of 133 m2 and a 10 square meters terrace in the pedestrian street outside. House consists of 2 separate units, fully equipped for a pleasant stay. It can be rented completely or partially.

Unit 1, 33 square meters

Street floor: 2 bedroom, small kitchen with dining area, hall, shower room with toilet, air conditioning, floor heating, TV, and free wireless internet. Own entrance, completely separated from the rest of the House. The house has 3 stars and newly furnished.

Unit 2, 100 square meters

Floor 1: Separate entrance, hall, large kitchen with dining room, hallway and balcony.

Floor 2: Hall, bathroom with shower, WC, large living room, 2 bed sofas with 4 berths, TV and wireless internet.

Floor 3: Hall, bathroom with shower, WC, 1 bedroom with double bed, 1 bedroom with bunk bed in full length, TV and wireless internet.

Distance: 2 minute walk to the fruit and vegetable market, 3 minute walk to the harbor – Riva and Diocletian Palace. 5 minutes to the train and bus station, 10 minutes to the City Beach Bacvice.

Location

Split city, Dalmatia coast

Split is the second-largest city of Croatia after the capital Zagreb, the largest city in Dalmatia and the largest city on the Croatian coast. It lies on the eastern shore of the Adriatic Sea and is spread over a central peninsula and its surroundings. An intraregional transport hub and popular tourist destination, the city is linked to the Adriatic islands and the Apennine Peninsula.

Are you looking for something else?