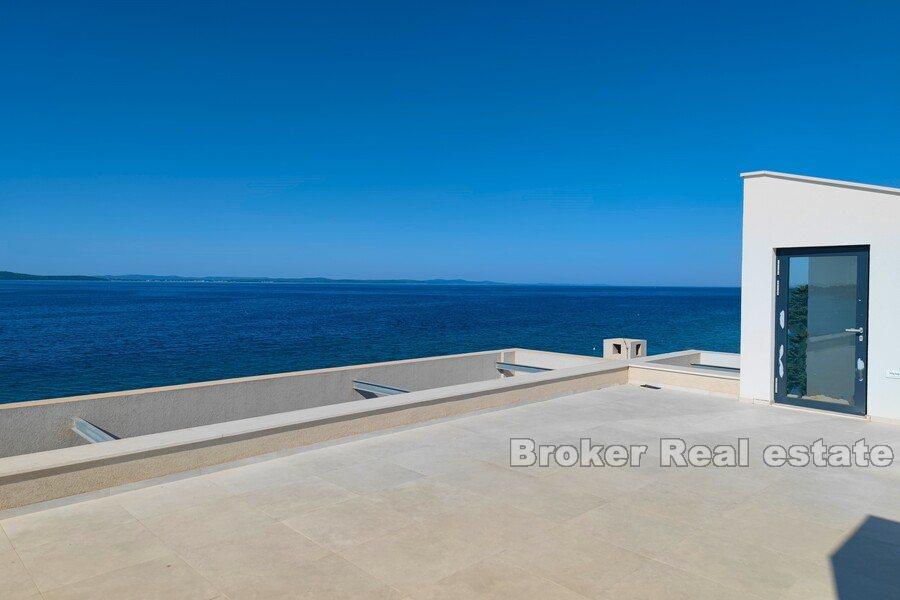

Croatia, Dalmatia coast, Zadar city - Luxury villa with pool and sea view

ID: 2018/191Basic information

Living space:220 m2

Land space:484 m2

Bedrooms:4

Bathrooms:4

Sea distance:35 m

Property advantages

- Sea view

- Swimming pool

- Newly built

- Luxury

Amenities

- Energy Certificate

- Modern

- Parking

About the property

Modernly designed luxury villa with pool and sea view, located in a small village near the city of Zadar.

The property is located on a plot of 484m2, total living area of 220m2 and is spread over three floors.

The ground floor has one bedroom with double bed, fully equipped kitchen and dining room, and living room

and a small toilet. On the first floor there are three air-conditioned bedrooms. One is the children’s room while the

other two bedrooms have a double bed and bathrooms with access to loggias overlooking the sea.

On the second floor there is a large roof terrace with deck chairs, outdoor furniture

and jacuzzi.

All bathrooms are en suite and have walk in showers and underfloor heating. The ground floor leads to the terrace and

garden where a heated pool and deck chairs are located. The villa is fully fenced and offers privacy.

There is plenty nearby sandy and pebble beaches with crystal clear sea surrounded by green Mediterranean vegetation.

Also not far from the place there are several national parks. Except for a quiet family vacation the house is ideal

for tourist rental.

Location

Zadar city, Dalmatia coast

Zadar is the oldest continuously inhabited city in Croatia. It is situated on the Adriatic Sea, at the northwestern part of Ravni Kotari region. Because of its rich heritage, Zadar is today one of the most popular Croatian tourist destinations, named "entertainment center of the Adriatic" by The Times and "Croatia's new capital of cool" by The Guardian.

Are you looking for something else?