Croatia, Dalmatia coast, Zadar city - Semi-detached modern villa with swimming pool

ID: 2022/162Basic information

Living space:150 m2

Land space:300 m2

Bedrooms:3

Bathrooms:3

Floors:2

Sea distance:100 m

Property advantages

- Sea view

- Swimming pool

- Newly built

Amenities

- Energy Certificate

- Modern

- Parking

About the property

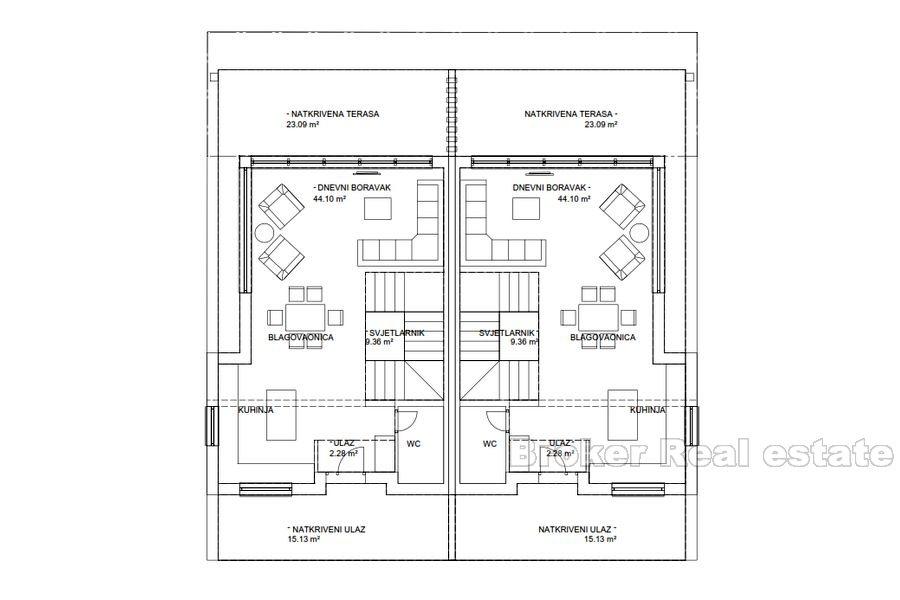

There are two semi-detached modern villas for sale, vertically separated – left or right side, located in a building under construction near the city of Zadar. Each living unit consists of ground floor with large yard, first floor and roof terrace. The planned completion of construction is June 2020.

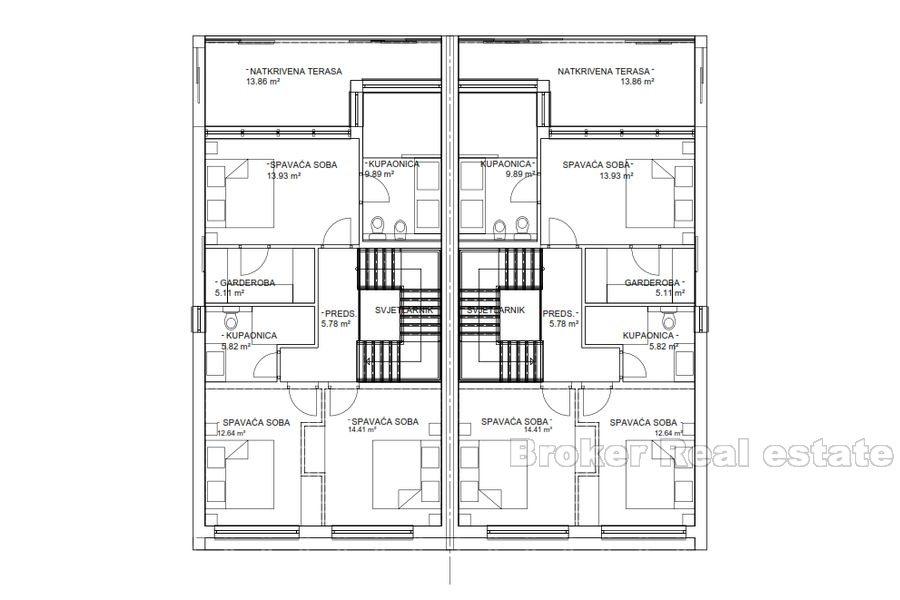

The ground floor consists of a large living room, kitchen and dining room, toilet, entrance hall and stairs for the upper floor, all conceived as an open space. On the upper floor there are two bedrooms for guests, a bathroom and a large main bedroom with built-in wardrobe and bathroom. From the hallway, there is an entrance onto roof terrace with a sunbathing area, a summer kitchen, a solar shower and a Jacuzzi.

The villa has a beautifully landscaped and fenced yard that provides complete privacy and security while the yard is dominated by an outdoor pool surrounded by a large covered balcony and a Mediterranean garden. Outdoor wall is paved with Brac stone. Given the combination of modern and traditional style with this beautiful, open sea view, the entire facility will leave no one indifferent.

Location

Zadar city, Dalmatia coast

Zadar is the oldest continuously inhabited city in Croatia. It is situated on the Adriatic Sea, at the northwestern part of Ravni Kotari region. Because of its rich heritage, Zadar is today one of the most popular Croatian tourist destinations, named "entertainment center of the Adriatic" by The Times and "Croatia's new capital of cool" by The Guardian.

Are you looking for something else?